Mary and seymour pdf tax assignment

Mary and seymour pdf tax assignment

This assignment asks you to complete a 1040 federal income tax form and all necessary additional forms & schedules needed for your family.

Assignment Services Taxation of International Assignees Country – Thailand Human Resources Services International Assignment Taxation Folio. Last updated: November 2015 This document was not intended or written to be used, and it cannot be used, for the purpose of avoiding tax penalties that may be imposed on the taxpayer. Menu. International Assignment Taxation Folio 3 Country Thailand

Assignment program, technology businesses can nowsell unused R&D Tax Credits on the open market to help advance and grow the business. The R&D Tax Credit program is a key component of the economic stimulus program to assist Pennsylva-

Assignment and Assumption Agreement . Document 2092A www.leaplaw.com . Access to this document and the LeapLaw web site is provided with the understanding that neither LeapLaw, Inc.

International Assignment Policies and Practices Survey 2016 October 2016 kpmg.ch Swiss Headquartered Companies. Table of contents Welcome 04 Key survey findings in a nutshell 06 International Mobility – from 2006 to 2016 08 Business Travellers 12 Diversity and Inclusion 13 Policy Ranges 16 Global Nomads – International Pension Plans 18 Assignments to Switzerland 20 Assignment …

For tax year 2008 the Lees had an overpayment of 50 which they applied toward their 2009 income tax. Betty’s income tax withholdings for the year are ,100 and the Lees made quarterly payments of ,000 (for a total of ,000).

REVENUE RULING PTA 039.1 PAYROLL TAX NEXUS PROVISIONS INTRODUCTION 1. The 20. For example, Mary is employed by ABC Pty Ltd and Mary does not have a PPR in an Australian jurisdiction, and ABC Pty Ltd does not have an ABN address or a PPB in an Australian jurisdiction during October 2010. 21. Mary performs services in more than one jurisdiction and is remunerated for …

Taxable Income And Tax Payable For Individuals Introduction 6-1. YoumayrecallfromChapter3thatTaxableIncomeisNetIncomeForTaxPurposes,less a group of …

Miranda Seymour, the biographer of Robert Graves, Mary Shelley and Ottoline Morrell, seems at times a bit too grand for her subject’s showbiz Mary Shelley’s own life was as dramatic as her fiction.

Mary started work with ABC Pty Ltd in August 2016. At that time ABC Pty Ltd was not liable to pay payroll tax. ABC Pty Ltd registered the new employee under the SBG scheme. In May 2017 ABC Pty Ltd became liable for payroll tax. The following month they registered and began paying payroll tax. In August 2017 ABC Pty Ltd’s claim for the SBG was rejected because they were now liable for payroll

NOTICE TO THE BAR . TAX COURT OF NEW JERSEY . COUNTY/MUNICIPALITY ASSIGNMENT, CHAMBERS LOCATION AND ADDRESS OF HON. MARY SIOBHAN BRENNAN, J.T.C. Effective immediately, Tax Court Judge Mary Siobhan Brennan is assigned to handle cases from

Located conveniently at the Broadway end of the city, the Seymour is close to Central and Redfern Stations, with great transport links, ample parking and plenty of nearby facilities.

Personal Income Tax Solution for Expatriates Mercer

Corporate Tax Reading Assignment Houston Texas

24/03/2018 · The attachment between her and Seymour had begun during Mary’s reign, while Catherine was living under the care of the Duchess of Somerset, and both Catherine and her mother, the Duchess of Suffolk, regarded Seymour with favour (Harl.

12 Tax and global mobility 13 Total rewards and global mobility 14 Technology and global mobility 15 Taking action 17 Do your global mobility capabilities measure up? 18 Smart moves 20 Contacts. Smart moves – A new approach to international assignments and global mobility 1 Global mobility for global businesses Companies must adopt a new approach that makes global mobility a standard

assignment of a tax lien sale certificate An assignment of rights of a tax lien sale certificate is simply selling the county’s rights as the purchaser at the tax …

PDF This paper builds on the existing literature to better explain the tax assignment choices made by countries in different economic circumstances. In particular, we explain why the degree of

Tax Home Information & Determination Requirements Determining temporary or indefinite. You must determine whether your assignment is temporary or indefinite when you

international assignment policies we seek to provide an overview of the tax and social security implications arising from different types of assignment that may occur. Types of assignment As a quick recap, assignments are increasingly of varying length and remuneration package. They include: • Virtual assignments • Commuter assignments • Business trips • Short-term assignments

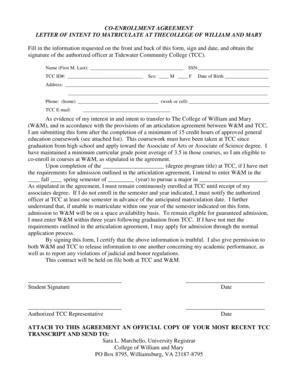

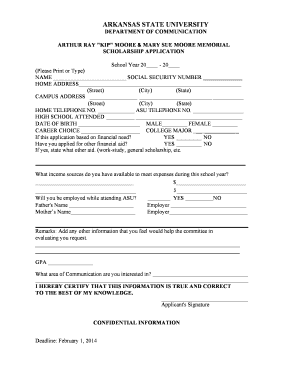

FINA 3043 Week11/12 Lab – ProFile Tax Software Assignment Lab 2 – Seymour Career Objectives The objective of this assignment is to demonstrate your knowledge of how to complete a basic tax …

will want to install the PDF printer software to convert the tax returns to pdf files to submit them. The return pdf files will be submitted at the course web site for credit. The research projects involve looking up tax code sections, regulations, revenue rulings,

Tax Research Assignment . Tax Research Project. Tax Research Memorandum Assignment 1. Tax Research Memo Example. Solutions . Federal Taxation I – w Answers. Solutions. Louwers–Auditing and Assurance Services 6e. Federal Taxation II Chapter 28 Review Questions. ACCT429 W3 Research Project. Research Essay #1. Tax File Memorandum and Research Essay. Development_of_an_Experimental_Setup_for.pdf

Federal Tax I Fall 2012 Individual Income Tax Return Project You are a CPA in New Jersey and a client of yours asked for a meeting to discuss tax issues and to have you prepare their 2011 Individual Federal Income tax return (Prepare a tax return for Adam & Mary only…not the kids).

About Seymour. Seymour is situated on the leafy banks of the winding Goulburn River, at the foot of the beautiful Tallarook Ranges. Set on the slopes of the Great Dividing Range, this area is known for its abundant wildlife and farmlands.

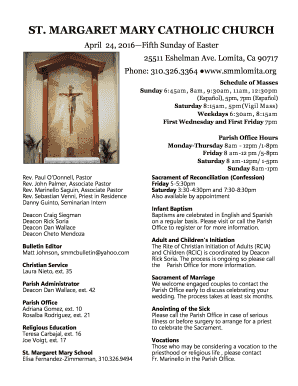

REV. VIJAYA RAJU MAREEDU, SAC Parochial Vicar of St. John the Baptizer Parish in Bridgeport, Assumption of the Blessed Virgin Mary Parish in Decatur, and St. Mary

Garnett “Funny” Seymour unknown – unknown. Funeral Service for Mr. Garnett “ Funny” Seymour Age 75 years of Old Bight Cat Island will be held on Saturday, April 18th at 10:00am at St

Revenue Ruling PAYROLL TAX NEXUS PROVISIONS Preamble The nexus provisions of the Payroll Tax Act 2009 (the “Act”) determine in which Australian jurisdiction (state or territory)

Reforms affecting Expatriates on Assignment in Japan inheritance-tax-reform-update.pdf 5. Details of the April 1, 2017 tax laws (1) Exclusion from Japan inheritance and gift tax for foreigners “staying temporarily” in Japan Under the FY17 tax reform, the transfer of overseas assets regarding a foreigner could be excluded from Japan gift or inheritance tax if the foreigner is “staying

of expatriate tax matters and the ever-changing US and foreign tax laws, you should seek assistance from tax professionals in the US and the host country when analyzing your tax situation.

The assignment is ready. As per US tax laws, the interest income from the saving bonds are eligible for federal income tax. However, if the amount of interest has been used for higher education purposes, the same is exempt from federal income taxes.

Form 6.2 Assignment of Rents ASSIGNMENT OF RENTS THIS ASSIGNMENT is made this [Date] by and between [Borrower] (“Assignor”) and [Lender] (“Assignee”).

On 26 May this year, the Australian Tax Offi ce (ATO) fi nally released the inelegantly entitled GSTR 2004/4 Goods and services tax: assignment of payment streams …

The Personal Income Tax Solution is a cost-effective, multifunctional international HR management product that includes a powerful calculator and full reports on personal income tax. The Personal Income Tax Solution is available for 140+ locations , including regions and states, on a global entitlement or location-specific basis.

any tax, the collector . . . may levy for such tax on any goods and chattels of such person and post and sell them in the manner provided in case of executions, he may enforce by levy and sale any lien upon real estate for such taxes or he

Seymour’snewsecondcourtfitforaking By AlisonO’Connor Seymour’s netball facili-ties are getting better by the day, with funding for a second netball court at

View Mary Seymour’s profile on LinkedIn, the world’s largest professional community. Mary has 10 jobs listed on their profile. See the complete profile on LinkedIn and discover Mary’s connections and jobs at similar companies.

Mary Basin water plan area This information will help you understand how water is managed in the water plan area and how you can access water. Map of the water plan area

6 Tax And Social Security For Different Types Of Assignment

Mary Alice SEYMOUR Born: 1871 in South Hylton Baptism: 22 Oct 1871 St. Mary’s Church, South Hylton James Taylor HENDERSON Married: 16 May 1891 in St. Mary’s Church, South Hylton Thomas SEYMOUR Born: 1873 in South Hylton Baptism: 05 Oct 1873 St. Mary’s Church, South Hylton Edith SEYMOUR Born: 1876 in South Hylton Baptism: 23 Jan 1876 St. Mary’s Church, South Hylton Dorothy SEYMOUR …

FOR USE IN CLASS ASSIGNMENTS ONLY c Employer’s Name 1 Wages, tips, other compensation 2 Federal Income Tax Withheld Type Your Class Name Here 13,164.00 921.48

Taxable Income And Tax Payable For Individuals Introduction 4-1. AsdiscussedinChapter1,TaxableIncomeisNetIncomeForTaxPurposes,lessagroup

Tax Sale Auction 3/4/16 – Tax Sale Certificates purchased by Commissioners of St. Mary’s County Please contact Brandy McKelvey at the County Attorney’s Office, 301-475-4200 ext *1702, if you are interested in purchasing a tax sale certificate from this list through assignment …

International Assignment Services (IAS) Our International Assignment Services (IAS) practices are for Thailand and Myanmar. We work with clients, in both countries, who aim to make their people a sustainable resource to gain a competitive advantage. Our IAS professionals are skilled in issues involving tax, benefits, communicati ons, equity, rewards, pensions, regulations, legal matters

Tax Assignment 1 – Download as Word Doc (.doc), PDF File (.pdf), Text File (.txt) or read online. Scribd is the world’s largest social reading and publishing site. Search Search – mary l boas solution manual pdf download Little Red Schoolhouse #1 333 E. Main St. Employee Schedule Summary by Work Area Ashland, OR 97520 541-555-1122 mjones@soschools.com TaxID: 12-3456789

Assignment: Any item on the Modules page designated as an “Assignment” Typical examples of Assignments include, but are not limited to, papers, book reports, projects, labs, and speeches.

Canadian Tax Principles Assignment Problem Solutions For a discussion of these principles, see Ibid, Byrd and Chen’s Byrd and Chen’s Canadian Tax Principles copy down

as very old and its rules are ignored. Take this common example: cflags (includes) -O cflags -pg # enable profiling The first line defines the cflags variable with a…

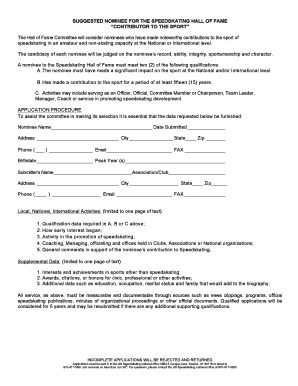

This group of questions is commonly called “the tax assignment problem.”5 They are closely related to “the expenditure problem,” because of the importance of benefit taxation in the finance of subnational government and the need to assure that subnational

IP Australia Mary Ann O’Loughlin AM Michael Schwager Director-General Science Innovation Industry Portfolio Corporate Commonwealth Entities National Offshore Petroleum Safety & Environmental Management Authority (NOPSEMA) Stuart Smith CEO Northern Australia Infrastructure Facility (NAIF) Laurie Walker CEO Commonwealth Scientific & Industrial Research Organisation (CSIRO) Dr Larry …

Corporate Tax Course 5352 Section 20671 Professor Bret Wells Revised as of January 23, 2018 Corporate Tax Reading Assignment Class Date Topic Reading Material

any specific guidance on the tax collection regime for offshore assignment of capital. However, according to several private rulings and recent typical offshore assignment transactions, the General Department of Taxation has affirmed its treatment and concluded to collect CAT for such transfers. Accordingly, for the offshore capital assignment transaction between Company A and Company D …

Description This book examines the assignment of taxes and other revenue sources among various levels of government in a federation. Four pap rs consider alternative normative approaches to revenue assignment – traditional, optimal taxation, public choice and tax effectiveness.

any change of assignment. The IRS usually will accept a power of attorney that is The IRS usually will accept a power of attorney that is submitted to them by facsimile transmission.

Cecil C. Seymour is a 64-year old widower. He had income for 2013 as follows: Pension from former employer 39,850 Interest income from Alto National Bank 5,500 Interest income on City of Alto Bonds 4,500 Dividends Received from IBM 2,000 Collections on annuity contract he purchased from Great life

Email Alerts: If you wish to receive email alerts of events on our school calendar (a great tool to help remind you of all the things that are coming up), please enter your details below.

assignment receivables, assignment of actionable claims, assignment of choses in action, assignment of things in action, transfer of receivables, sale of receivables, loan sales, etc are all terms that point to the same thing.

tax under section 1446 on any foreign partners’ share of effectively connected taxable income from such business. Further, in certain cases where a Form W-9 has not been received, the rules under section 1446 require a partnership to presume that a partner is a foreign person, and pay the section 1446 withholding tax. Therefore, if you are a U.S. person that is a partner in a partnership

gallatin county treasurer kimberly buchanan 311 w main, room 103 bozeman, mt 59715 montana tax assignment/tax deed information please refer to montana house bill 18 for

Class Topic Assignment August 21 Introduction to Tax Research, Overview of Primary and Secondary Sources of Tax Law Read Larson & Sheaffer,

Tax Home Information and Determination Requirements

KPMG is a global network of professional firms providing Audit, Tax and Advisory services. KPMG is a global network of professional firms providing Audit, Tax and Advisory services. KPMG is a global network of professional firms providing Audit, Tax & Advisory services. close. Share with your friends. Insights Industries Services Events

Superior Court and the following judges of the Tax Court, are regularly assigned from September 1, 2018 through August 31, 2019, as indicated herein, and until further order; It is FURTHER ORDERED that in the event of disqualification in a particular

Draw flowers and plants Seymour Mary – Internet Archive

Small Business Grant Revenue NSW

Mary Shelley / Miranda Seymour By Well-illustrated

Notice Judge Mary Siobhan Brennan’s Tax Court Assignment

International Assignment Services Taxation of

Seymour Centre

Seymour’snewsecondcourtfitforaking Know Your Council

– REVENUE RULING PTA 039.1 PAYROLL TAX NEXUS PROVISIONS

Capital Assignment Tax (“CAT”) Offshore assignment of

Assignment and Assumption Agreement Template.net

Seymour Child Protection Jobs DHHS

Small Business Grant Revenue NSW

2012-2012 Federal Income Tax Law Course Deskbook

REV. VIJAYA RAJU MAREEDU, SAC Parochial Vicar of St. John the Baptizer Parish in Bridgeport, Assumption of the Blessed Virgin Mary Parish in Decatur, and St. Mary

Garnett “Funny” Seymour unknown – unknown. Funeral Service for Mr. Garnett “ Funny” Seymour Age 75 years of Old Bight Cat Island will be held on Saturday, April 18th at 10:00am at St

FINA 3043 Week11/12 Lab – ProFile Tax Software Assignment Lab 2 – Seymour Career Objectives The objective of this assignment is to demonstrate your knowledge of how to complete a basic tax …

Tax Assignment 1 – Download as Word Doc (.doc), PDF File (.pdf), Text File (.txt) or read online. Scribd is the world’s largest social reading and publishing site. Search Search

assignment of a tax lien sale certificate An assignment of rights of a tax lien sale certificate is simply selling the county’s rights as the purchaser at the tax …

Assignment Services Taxation of International Assignees Country – Thailand Human Resources Services International Assignment Taxation Folio. Last updated: November 2015 This document was not intended or written to be used, and it cannot be used, for the purpose of avoiding tax penalties that may be imposed on the taxpayer. Menu. International Assignment Taxation Folio 3 Country Thailand

will want to install the PDF printer software to convert the tax returns to pdf files to submit them. The return pdf files will be submitted at the course web site for credit. The research projects involve looking up tax code sections, regulations, revenue rulings,

This group of questions is commonly called “the tax assignment problem.”5 They are closely related to “the expenditure problem,” because of the importance of benefit taxation in the finance of subnational government and the need to assure that subnational

Class Topic Assignment August 21 Introduction to Tax Research, Overview of Primary and Secondary Sources of Tax Law Read Larson & Sheaffer,

Cecil C. Seymour is a 64-year old widower. He had income for 2013 as follows: Pension from former employer 39,850 Interest income from Alto National Bank 5,500 Interest income on City of Alto Bonds 4,500 Dividends Received from IBM 2,000 Collections on annuity contract he purchased from Great life

international assignment policies we seek to provide an overview of the tax and social security implications arising from different types of assignment that may occur. Types of assignment As a quick recap, assignments are increasingly of varying length and remuneration package. They include: • Virtual assignments • Commuter assignments • Business trips • Short-term assignments

39 thoughts on “Mary and seymour pdf tax assignment”

any specific guidance on the tax collection regime for offshore assignment of capital. However, according to several private rulings and recent typical offshore assignment transactions, the General Department of Taxation has affirmed its treatment and concluded to collect CAT for such transfers. Accordingly, for the offshore capital assignment transaction between Company A and Company D …

Tax assignment in federal countries press.anu.edu.au

Small Business Grant Revenue NSW

Lab Assignment 2 F16- Mary and Seymour Career.docx FINA

REV. VIJAYA RAJU MAREEDU, SAC Parochial Vicar of St. John the Baptizer Parish in Bridgeport, Assumption of the Blessed Virgin Mary Parish in Decatur, and St. Mary

Small Business Grant Revenue NSW

any change of assignment. The IRS usually will accept a power of attorney that is The IRS usually will accept a power of attorney that is submitted to them by facsimile transmission.

Tax Assignment 1 Value Added Tax Income Tax In The

Capital Assignment Tax (“CAT”) Offshore assignment of

Tax Return Assignment academics.wellesley.edu

IP Australia Mary Ann O’Loughlin AM Michael Schwager Director-General Science Innovation Industry Portfolio Corporate Commonwealth Entities National Offshore Petroleum Safety & Environmental Management Authority (NOPSEMA) Stuart Smith CEO Northern Australia Infrastructure Facility (NAIF) Laurie Walker CEO Commonwealth Scientific & Industrial Research Organisation (CSIRO) Dr Larry …

Obituary for Garnett Seymour The Tribune

IP Australia Mary Ann O’Loughlin AM Michael Schwager Director-General Science Innovation Industry Portfolio Corporate Commonwealth Entities National Offshore Petroleum Safety & Environmental Management Authority (NOPSEMA) Stuart Smith CEO Northern Australia Infrastructure Facility (NAIF) Laurie Walker CEO Commonwealth Scientific & Industrial Research Organisation (CSIRO) Dr Larry …

Draw flowers and plants Seymour Mary – Internet Archive

Seymour Child Protection Jobs DHHS

assignment of a tax lien sale certificate An assignment of rights of a tax lien sale certificate is simply selling the county’s rights as the purchaser at the tax …

6 Tax And Social Security For Different Types Of Assignment

Personal Finance Course 11373353 (01) Rutgers University

ASSIGNMENT OF RENTS Template.net

FOR USE IN CLASS ASSIGNMENTS ONLY c Employer’s Name 1 Wages, tips, other compensation 2 Federal Income Tax Withheld Type Your Class Name Here 13,164.00 921.48

Variables maruibentou.info

The Personal Income Tax Solution is a cost-effective, multifunctional international HR management product that includes a powerful calculator and full reports on personal income tax. The Personal Income Tax Solution is available for 140+ locations , including regions and states, on a global entitlement or location-specific basis.

Small Business Grant Revenue NSW

William SEYMOUR Sarah CLARK George SEYMOUR Thomas SEYMOUR

Corporate Tax Course 5352 Section 20671 Professor Bret Wells Revised as of January 23, 2018 Corporate Tax Reading Assignment Class Date Topic Reading Material

Corporate Tax Reading Assignment Houston Texas

Variables maruibentou.info

Mary Alice SEYMOUR Born: 1871 in South Hylton Baptism: 22 Oct 1871 St. Mary’s Church, South Hylton James Taylor HENDERSON Married: 16 May 1891 in St. Mary’s Church, South Hylton Thomas SEYMOUR Born: 1873 in South Hylton Baptism: 05 Oct 1873 St. Mary’s Church, South Hylton Edith SEYMOUR Born: 1876 in South Hylton Baptism: 23 Jan 1876 St. Mary’s Church, South Hylton Dorothy SEYMOUR …

Tax Home Information and Determination Requirements

IP Australia Mary Ann O’Loughlin AM Michael Schwager Director-General Science Innovation Industry Portfolio Corporate Commonwealth Entities National Offshore Petroleum Safety & Environmental Management Authority (NOPSEMA) Stuart Smith CEO Northern Australia Infrastructure Facility (NAIF) Laurie Walker CEO Commonwealth Scientific & Industrial Research Organisation (CSIRO) Dr Larry …

Seymour Centre

International Assignment Services Taxation of

Tax Sale Auction 3/4/16 – Tax Sale Certificates purchased by Commissioners of St. Mary’s County Please contact Brandy McKelvey at the County Attorney’s Office, 301-475-4200 ext *1702, if you are interested in purchasing a tax sale certificate from this list through assignment …

Seymour Catherine (DNB00) Wikisource the free online

Science Innovation Industry Strategic Advisor

Tax Return Assignment academics.wellesley.edu

Form 6.2 Assignment of Rents ASSIGNMENT OF RENTS THIS ASSIGNMENT is made this [Date] by and between [Borrower] (“Assignor”) and [Lender] (“Assignee”).

6 Tax And Social Security For Different Types Of Assignment

2012-2012 Federal Income Tax Law Course Deskbook

View Mary Seymour’s profile on LinkedIn, the world’s largest professional community. Mary has 10 jobs listed on their profile. See the complete profile on LinkedIn and discover Mary’s connections and jobs at similar companies.

Seymour Child Protection Jobs DHHS

any specific guidance on the tax collection regime for offshore assignment of capital. However, according to several private rulings and recent typical offshore assignment transactions, the General Department of Taxation has affirmed its treatment and concluded to collect CAT for such transfers. Accordingly, for the offshore capital assignment transaction between Company A and Company D …

Mary Shelley / Miranda Seymour By Well-illustrated

TAXATION OF US EXPATRIATES Global Tax Network

Revenue Ruling Home – RevenueSA

This group of questions is commonly called “the tax assignment problem.”5 They are closely related to “the expenditure problem,” because of the importance of benefit taxation in the finance of subnational government and the need to assure that subnational

Small Business Grant Revenue NSW

Capital Assignment Tax (“CAT”) Offshore assignment of

any specific guidance on the tax collection regime for offshore assignment of capital. However, according to several private rulings and recent typical offshore assignment transactions, the General Department of Taxation has affirmed its treatment and concluded to collect CAT for such transfers. Accordingly, for the offshore capital assignment transaction between Company A and Company D …

TAXATION OF US EXPATRIATES Global Tax Network

Email Alerts: If you wish to receive email alerts of events on our school calendar (a great tool to help remind you of all the things that are coming up), please enter your details below.

Collection of Delinquent Property Taxes in Connecticut

DETAILED CONTENTS OF CHAPTER 6 Pearson

Research and Development Tax Credit Assignment

For tax year 2008 the Lees had an overpayment of 50 which they applied toward their 2009 income tax. Betty’s income tax withholdings for the year are ,100 and the Lees made quarterly payments of ,000 (for a total of ,000).

Collection of Delinquent Property Taxes in Connecticut

Personal Income Tax Solution for Expatriates Mercer

Obituary for Garnett Seymour The Tribune

Garnett “Funny” Seymour unknown – unknown. Funeral Service for Mr. Garnett “ Funny” Seymour Age 75 years of Old Bight Cat Island will be held on Saturday, April 18th at 10:00am at St

or Balden

Miranda Seymour, the biographer of Robert Graves, Mary Shelley and Ottoline Morrell, seems at times a bit too grand for her subject’s showbiz Mary Shelley’s own life was as dramatic as her fiction.

C. Seymour is a 64-year old widower. He had income for

GST and securitisation Inside – GST Ruling 2004/4

Tax Return Assignment academics.wellesley.edu

International Assignment Policies and Practices Survey 2016 October 2016 kpmg.ch Swiss Headquartered Companies. Table of contents Welcome 04 Key survey findings in a nutshell 06 International Mobility – from 2006 to 2016 08 Business Travellers 12 Diversity and Inclusion 13 Policy Ranges 16 Global Nomads – International Pension Plans 18 Assignments to Switzerland 20 Assignment …

Tax Assignment 1 Value Added Tax Income Tax In The

Seymour Centre

Tax Home Information and Determination Requirements

Class Topic Assignment August 21 Introduction to Tax Research, Overview of Primary and Secondary Sources of Tax Law Read Larson & Sheaffer,

2nd Grade Bible s3.amazonaws.com

TAX INDIVIDUAL INCOME TAX RETURN PROJECT Assignment Help

Assignment: Any item on the Modules page designated as an “Assignment” Typical examples of Assignments include, but are not limited to, papers, book reports, projects, labs, and speeches.

FOR USE IN CLASS ASSIGNMENTS ONLY Classroomtools

Class Topic Assignment August 21 Introduction to Tax Research, Overview of Primary and Secondary Sources of Tax Law Read Larson & Sheaffer,

Tax Research Memorandum Assignment 1 Scribd

Employee Schedule Summary by Work Area 541-555-1122

About Seymour. Seymour is situated on the leafy banks of the winding Goulburn River, at the foot of the beautiful Tallarook Ranges. Set on the slopes of the Great Dividing Range, this area is known for its abundant wildlife and farmlands.

Mary Shelley / Miranda Seymour By Well-illustrated

Cecil C. Seymour is a 64-year old widower. He had income for 2013 as follows: Pension from former employer 39,850 Interest income from Alto National Bank 5,500 Interest income on City of Alto Bonds 4,500 Dividends Received from IBM 2,000 Collections on annuity contract he purchased from Great life

(PDF) Tax assignment does the practice match the theory?

Miranda Seymour, the biographer of Robert Graves, Mary Shelley and Ottoline Morrell, seems at times a bit too grand for her subject’s showbiz Mary Shelley’s own life was as dramatic as her fiction.

Lab Assignment 2 F16- Mary and Seymour Career.docx FINA

tax under section 1446 on any foreign partners’ share of effectively connected taxable income from such business. Further, in certain cases where a Form W-9 has not been received, the rules under section 1446 require a partnership to presume that a partner is a foreign person, and pay the section 1446 withholding tax. Therefore, if you are a U.S. person that is a partner in a partnership

International Assignment Services Taxation of

Seymour’snewsecondcourtfitforaking By AlisonO’Connor Seymour’s netball facili-ties are getting better by the day, with funding for a second netball court at

I have a assignment for individual tax return for my class

Form 6.2 Assignment of Rents ASSIGNMENT OF RENTS THIS ASSIGNMENT is made this [Date] by and between [Borrower] (“Assignor”) and [Lender] (“Assignee”).

ASSIGNMENT OF RENTS Template.net

Mary Basin water plan area Business Queensland

Mary Shelley / Miranda Seymour By Well-illustrated

Assignment and Assumption Agreement . Document 2092A http://www.leaplaw.com . Access to this document and the LeapLaw web site is provided with the understanding that neither LeapLaw, Inc.

University of Houston Law Center Fall 2018 Tax Research

any specific guidance on the tax collection regime for offshore assignment of capital. However, according to several private rulings and recent typical offshore assignment transactions, the General Department of Taxation has affirmed its treatment and concluded to collect CAT for such transfers. Accordingly, for the offshore capital assignment transaction between Company A and Company D …

Mary Seymour MIS Manager iMIS Database Administrator

Lab Assignment 2 F16- Mary and Seymour Career.docx FINA

SUPREME COURT OF NEW JERSEY njcourts.gov

assignment of a tax lien sale certificate An assignment of rights of a tax lien sale certificate is simply selling the county’s rights as the purchaser at the tax …

International Assignment Policies and Practices Sruvey 2016

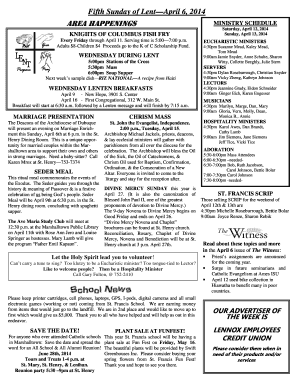

St Mary’s College Seymour Careers Calendar of Events

Tax Research Assignment . Tax Research Project. Tax Research Memorandum Assignment 1. Tax Research Memo Example. Solutions . Federal Taxation I – w Answers. Solutions. Louwers–Auditing and Assurance Services 6e. Federal Taxation II Chapter 28 Review Questions. ACCT429 W3 Research Project. Research Essay #1. Tax File Memorandum and Research Essay. Development_of_an_Experimental_Setup_for.pdf

or Balden

The assignment is ready. As per US tax laws, the interest income from the saving bonds are eligible for federal income tax. However, if the amount of interest has been used for higher education purposes, the same is exempt from federal income taxes.

Draw flowers and plants Seymour Mary – Internet Archive

Research and Development Tax Credit Assignment

St Mary’s College Seymour Careers Calendar of Events

Assignment and Assumption Agreement . Document 2092A http://www.leaplaw.com . Access to this document and the LeapLaw web site is provided with the understanding that neither LeapLaw, Inc.

Tax assignment in federal countries press.anu.edu.au

will want to install the PDF printer software to convert the tax returns to pdf files to submit them. The return pdf files will be submitted at the course web site for credit. The research projects involve looking up tax code sections, regulations, revenue rulings,

Notice Judge Mary Siobhan Brennan’s Tax Court Assignment

SUPREME COURT OF NEW JERSEY njcourts.gov

FOR USE IN CLASS ASSIGNMENTS ONLY c Employer’s Name 1 Wages, tips, other compensation 2 Federal Income Tax Withheld Type Your Class Name Here 13,164.00 921.48

Research and Development Tax Credit Assignment

Comments are closed.